How to Make Materiality More Inclusive – Without Losing Focus

Alison Taylor, Clinical Professor, NYU Stern School of Business and author of the newly released Higher Ground: How Business Can do the Right Thing in a Turbulent World, shares the key steps for ensuring a strategic focus while leading an inclusive materiality assessment across stakeholders.

Materiality assessments have traditionally been approached like any other top-down organizational change initiative. They focus on senior leaders and influential external stakeholders, but do not tend to consult the wider workforce. And, because there is a tendency to treat sustainability initiatives as reputational risk management, many corporations end up with a laundry list of sustainability “stuff” that fails to differentiate between risk, innovation opportunity, and impact.

Today, there are two important imperatives. The first imperative is to consider the rise of employee voice and activism. If you do not consult your workers on priorities, you risk setting off conflict and opening yourself up to demands on dozens of issues. Even more importantly, young employees are more likely to feel passionately about sustainability, and to be informed about risks, priorities, and emerging trends than senior leaders.

The second is to be more strategic and focused about what problems you will take on and where you have leverage. This is tricky, not least because if you open up the process to more voices, you will inevitably invite an even broader range of ideas as to what should be a priority.

Here’s how to approach this being more inclusive, without becoming overwhelmed and losing direction.

Consult your workforce on prioritization

When you gather internal stakeholder insights, don’t restrict yourself to the C Suite. You’ll collect the most comprehensive insights if you combine an internal survey with detailed internal and external interviews. Inside the company, it’s important to talk to leaders in all key functions. However, anticipate that leaders of specific divisions and functions will make selections that reflect their own obsessions and agendas. Defensive politicking is common.

It’s therefore smart to gather the views of the full workforce, and to also give consideration to how you impact gig and contract workers. While conducting focus groups with staff in a range of regions and functions is ideal, a survey can be a good alternative. Relatively junior employees might focus more on pet concerns, but are also likely to care less about status, loyalty, and reputation. In fact, when feedback from the workforce differs significantly from the leadership team’s views, you will have unearthed a good indicator of latent frustration or misalignment.

These conversations will teach you much about internal sources of pressure, enthusiasm, pain, and tension. You will better understand what employees expect and value. You may identify people who can lead initiatives and make decisions. In short, you’ll be positioned to get something done once the assessment is complete.

Prioritize Ruthlessly

Once you comprehend the landscape of relevant issues and gather stakeholder opinions, you must prioritize ruthlessly. You will have identified a broad range of relevant issues and may be tempted to think they should get equal priority for balance and consistency. Without clear choices, though, you’ll wind up stuck in a swamp of undifferentiated virtue signaling.

This has become even more challenging as EU regulations weigh towards a more compliance led, and less strategic approach. While EU regulation promises to bring a seriousness and rigor to the process, as well as budget and senior strategic attention, there is a risk that the breadth and specificity of requirements overwhelms and concerns compliance teams, who themselves may have a very limited knowledge of sustainability. This necessitates far more cross-functional outreach for the sustainability team and means it is more important than ever that sustainability professionals are able to think strategically and help the whole organization prioritize.

When prioritizing, companies often face pressure to escalate some issues and downplay others that might draw negative attention. It is easy to wind up trapped between external critiques and internal resistance. That’s how a process that starts with materiality ends up as checking a box. An independent voice in the room can help, but only if that voice has internal credibility.

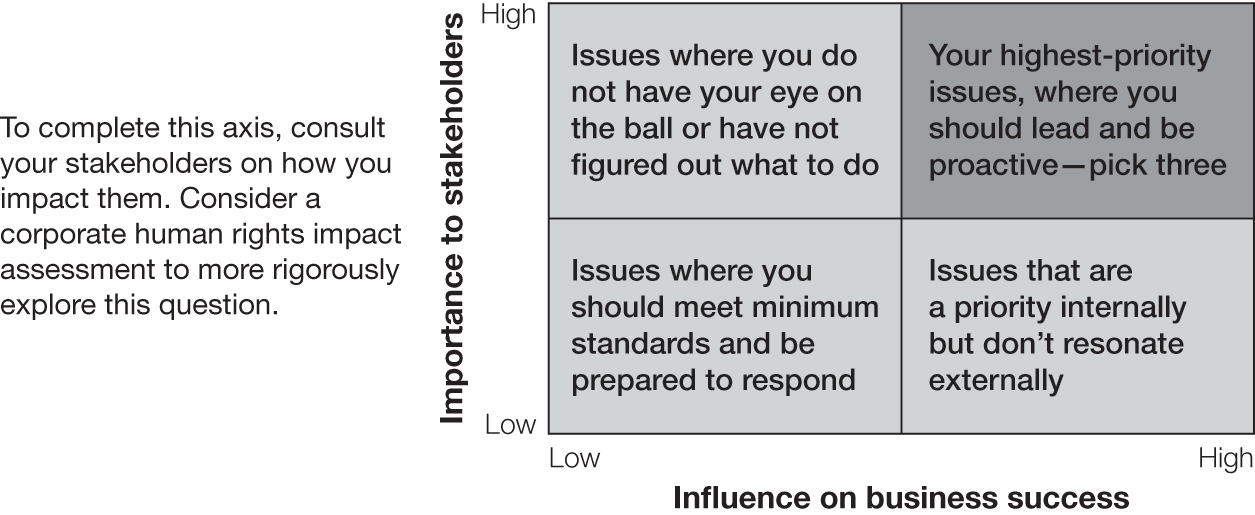

Most important is the top right quadrant of your materiality matrix. Here, you’ll see the environmental and social issues deemed critical by both internal and external observers. Each issue in this quadrant is likely to be multidimensional; it presents risks and opportunities and ethical and commercial imperatives.

In this quadrant, you’ll find the areas where close, ongoing dialogue with key external experts and other stakeholders will be most valuable. If you look for connections among these issues, you might see that they all relate to the same root cause (such as climate change or worker rights). This is the time to engage in robust debate in order to shape a distinctive position aligning rhetoric and action. Ultimately, these questions should be treated with the same seriousness as any corporate strategy imperative. It’s best if you can confidently select a single area of focus. Choose more than three issues, and you will be biting off more than you can chew.

If you’ve conducted your analysis rigorously, priority issues will include those that are critical—even existential—for your core business model. If your company manufactures medicines, you’ll see product liability and safety. If it makes clothing, there’s no avoiding questions of environmental impacts and worker rights in your supply chain. It’s common to view these issues solely as risks or problems, but you should be mindful that they may present significant opportunities for innovation and strategic advantage.

Clear prioritization makes developing a strategy less excruciating. You’ll be less inclined to put a range of incompatible issues into that bucket of ESG stuff or to concentrate on messaging over substance.

Once you’ve identified your priorities, you can get down to considering how to incentivize innovation, better manage risk, and/or establish ethical oversight. While you might want to look at what competitors are doing and saying, your objective is differentiation, not mimesis. Sam Hartsock, who runs qb, a sustainability consultancy, and whose clients include Bumble and Ben & Jerry’s tells me: “We explore whether specific issues present operational risks, ethical imperatives, or impact/innovation opportunities. This helped drive deeper reflections, before jumping to solutions.”

If your focus is sharply strategic, and you clearly see the challenges and opportunities each issue presents, you’ll find it much easier to incentivize the core business to focus on these issues. Even more critical, you’ll know what expertise your sustainability team (and board) needs. A failure to focus will mean that instead of recruiting for deep expertise managing your high priority material issues, your sustainability team’s job will default to data gathering, coordination, and impression management. General Motors is a good example of a company that adopted a focused strategy on a root-cause issue: climate change.

Developing a sharp strategic focus does not let you ignore other issues. At the very least, you’ll need to report and disclose information about all the issues on your materiality map. A materiality process helps identify areas where your organization has considerable impact on stakeholders but is unfocused or unprepared to act. It will also help you identify key operational priorities you are simply expected to get right. Being equipped with this nuanced understanding of issues and stakeholder pressures will enable you to proceed confidently.

About the Author:

Alison Taylor

Clinical Professor, NYU Stern School of Business

Author,

Higher Ground: How Business Can do the Right Thing in a Turbulent World

Adapted from Higher Ground: How Business Can Do the Right Thing in a Turbulent World by

Alison Taylor. Copyright 2024 by Alison Taylor. All rights reserved.

Photo: PxHere

Read perspectives from the ISSP blog